🇺🇸 In God We Trust | 🇮🇱 Am Yisrael Chai

Today I became an American Israeli.

It took the darkest day in Israel’s history as a State for me to understand that this is the safest home in the world for we, the Jewish people. I was born in America to the great grandson of immigrants who fled Europe. We heard stories about the Holocaust, but the United States of America always provided us safe passage.

When those rockets fell on my head, I finally understood that someone is trying to kill me even though I did nothing to them except be Jewish.

This is a feeling I don’t think any American can relate to unless they feel it deep in their bones like I have in the days since 10/7. I’m a proud Jew. I want to live in peace. Israel is our home, my home.

👎 The Case for Downvotes

In the current digital age, the boundaries of social media continue to expand and evolve. Among these developments, Meta’s recent launch of the "Threads" app has captured significant attention. While the new platform is reminiscent of Twitter in many ways, it also carries the hope of offering unique features and benefits. However, one must question if merely porting a new social graph or introducing a potentially superior algorithm is sufficient to distinguish Threads from Twitter and enhance user experience.

The introduction of a new social media platform naturally leads to comparisons and predictions about which will come out on top, as does their barking about fighting in the octagon. However, as it stands, neither Twitter nor Threads feature a crucial tool for user feedback and content regulation: the downvote.

Examining the Toxicity on Social Media Platforms

While Twitter has often been criticized for the toxicity prevalent among its users, it's essential to remember that the digital world mirrors the physical one. Just as the public square is not inherently a hellscape because of certain deplorable groups (like neo-Nazis outside of a Georgia synagogue), neither is Twitter or any other social media platform intrinsically toxic because of its user base.

Similarly, Threads, while managed under the watchful eye of Mark Zuckerberg, doesn't inherently promise a less toxic environment than Twitter, just as Twitter doesn't ensure a more favorable one under Elon Musk (though certainly with more freedom of speech). The determinant of a positive or negative environment largely lies in the tools available for users to interact, regulate, and shape their community.

Addressing the Current Feedback Mechanisms on Twitter

Twitter, as it stands, offers two ways for users to express their negative reactions towards content or users: muting and blocking. However, these are not adequate measures for shaping a healthier discourse. The mute function merely hides specific content from the user’s feed, doing nothing to mitigate the spread of harmful or inappropriate content, while the block feature cuts off interaction entirely with another user—a rather extreme response, barring any chance for constructive dialogue or understanding.

In contrast, a heart symbol, or “favorite,” offers a positive reinforcement mechanism. It allows users to appreciate and promote content they find enjoyable or agreeable. But without a converse mechanism to express disagreement or disapproval, the heart alone becomes an incomplete measure for engagement. This one-sided feedback system can create an illusion of unanimous approval, ignoring the range of human reactions that fall in the “disagree” to “disapprove” spectrum.

The Power of the Downvote

The downvote is a powerful tool for content regulation, widely used and appreciated on platforms like Reddit and YouTube. It allows users to express disapproval for content in a non-confrontational manner, promoting an environment that fosters self-regulation and quality control. A downvote system can balance the feedback mechanism, counteract the "like" or "heart" features, and promote quality content by reducing the visibility of offensive or misleading content.

Potential Drawbacks and Mitigation

Critics may argue that downvotes can be used as a tool for online bullying or “brigading.” Indeed, any feedback system is susceptible to misuse. But measures can be put in place to mitigate this:

Limit Downvotes: Twitter or Threads could implement a system that limits the number of downvotes a user can give within a specific timeframe. This would deter users from downvoting en masse purely out of spite or malice.

Anonymous Downvoting: Downvotes should be anonymous to prevent retaliation and maintain a focus on the content rather than the user.

Reason for Downvote: Users could be asked to provide a reason for downvoting, allowing Twitter or Threads to better understand patterns of misuse and make necessary adjustments.

The Battle of Platforms

A platform that introduces downvoting first might gain an advantage. It would signal to users that their diverse reactions are valued and considered. It would show that the platform is committed to self-regulation and quality content promotion. Thus, the incorporation of a downvote feature could potentially sway the balance of user preference between Twitter and Threads.

The Future of Social Media Discourse

In conclusion, while the competition between social media platforms will undoubtedly continue, the implementation of features like the downvote system will play a significant role in shaping user experience and discourse quality. As Threads enters the arena, it remains to be seen which platform will seize the initiative and take this crucial step first. After all, the ultimate goal should be to foster a balanced, less toxic online environment where diverse opinions can be shared and appreciated respectfully.

🇺🇸 Make Venture Soft Again

In the nascent years of venture capital, software was the battleground of innovation. Pioneers like Microsoft, Oracle, and SAP laid down the foundation for what would become a multi-trillion-dollar industry. Fast forward to the last several years , and venture capitalists were enticed by the allure of other sectors, notably direct-to-consumer (DTC) companies. However, this article contends that for the venture asset class to perform well, it's time to go back to the roots and focus more on software investments.

The Software Advantage

Software startups, especially those that leverage network effects, have unique qualities that make them incredibly attractive for venture capital.

Scalability: Software companies are inherently scalable. Once a software product is built, it can be distributed to millions, if not billions, of users worldwide at near-zero marginal costs.

Network Effects: Startups like Facebook, LinkedIn, and Airbnb have demonstrated the potency of network effects. As more users join the network, the value of the platform increases for both old and new users, creating a virtuous cycle that's tough to break.

Recurring Revenue: Software companies, particularly SaaS (Software as a Service), have ushered in an era of predictable, recurring revenue streams. The subscription model not only assures regular income but also builds customer loyalty.

Gross Margin: Software has high gross margins. Once the initial development is done, the cost to produce an extra copy is nearly zero.

The DTC Misstep

Over the past few years, VC firms have been increasingly seduced by DTC startups. Companies like Casper, Harry’s, and Warby Parker, with their unique brand appeal and customer engagement, appeared as potential unicorns. Yet, many of these investments have failed to deliver the kind of returns VCs expect.

The primary reason for this is simple: these companies are fundamentally different from software businesses.

Firstly, DTC companies operate on slim margins. Unlike software, the cost of goods sold (COGS) for DTC businesses is high. Each product sold requires raw material, production, and often complex logistics. Coupled with high customer acquisition costs, these expenses significantly cut into potential profits.

Secondly, scalability is harder to achieve. Each unit of a product has to be manufactured, stored, and shipped. And as these businesses scale, complexity and costs often scale linearly, negating economies of scale that software companies enjoy.

Lastly, DTC companies face intense competition and require significant brand differentiation and marketing spend. Creating a unique brand in a crowded market requires not only a unique product but also significant outlay for marketing and customer acquisition.

Venture's Soft Comeback

Venture capital, as an asset class, is designed for high risk and high reward. It thrives on investing in startups that can grow quickly, achieve strong network effects, and provide outstanding returns. For the foreseeable future, software companies seem to be best suited for this model.

Venture capitalists are now rethinking their strategies, prioritizing businesses with proven scalability, high gross margins, and strong network effects — traits that are the hallmarks of successful software companies.

The venture capital landscape is cyclical, characterized by periods of fascination with different sectors and trends. However, as we look to the future and seek the next cohort of world-changing companies, the case to "Make Venture Soft Again" has never been stronger. It’s time to return to the roots, and those roots are firmly embedded in software.

💧 Water as the New Platform

A rising tide in the world of investment has been capturing my attention for the past five years, and it's finally reaching the mainstream conversation: water.

Entrepreneur and investor, Yishan Wong, recently underscored this potential in a Twitter proclamation, "If you want to know the next big thing in 'real atoms' investment macro-trends, I'll tell you right now. It's WATER!"

This statement rings true to what some of us have humbly observed and believed for some time now. While it is gratifying to have identified this potential years ago, the focus now is not on the prediction, but on the promise this vital resource holds. With escalating climate crises and mounting pressure on our existing water resources, water-related investments are poised to be the next big wave. Water, a tangible resource, has immense potential to become a platform for a range of innovative investment opportunities. This concept may initially seem like uncharted territory, but let's dive in to explore the depths of this burgeoning economic sea.

In the age of digitalization, the concept of a "platform" has transformed our interaction with the world. From social media to e-commerce, cloud computing to streaming services, platforms have created a framework for innovation, collaboration, and economic growth. Now, this concept of a "platform" is making a splash in an unexpected domain.

Water - a vital resource that is fundamental to life, yet often undervalued and poorly managed - is emerging as a significant investment opportunity, where it's being framed as a "platform". But how can water, a tangible resource, become a platform, an intangible framework? Let's dive in.

Imagine a digital platform designed to facilitate investments, trades, and management of water-related assets, resources, and projects. This platform could be a marketplace for everything from funding innovative water purification technologies to facilitating the trading of water rights. Here's how such a "water platform" could reshape the investment landscape:

Water Rights Trading: The rights to use water from a particular source are bought and sold in several countries, including parts of Australia and the U.S. Our hypothetical platform could provide a marketplace for these transactions, offering a secure, transparent platform that maximizes efficiency and minimizes waste.

Infrastructure Investment: The need for improved water infrastructure is a worldwide concern. This platform could connect investors to such projects, ranging from local water purification plants to expansive pipeline systems. This would not only offer significant investment returns but also contribute to improved water access and quality.

Water Quality and Purification Technologies: As our planet faces increasing water pollution, investment in new water purification technologies is more crucial than ever. This platform could be a nexus of innovation, allowing investors to support the development and deployment of these vital technologies.

Water Sustainability Projects: In a world increasingly focused on sustainability, this platform could link investors to projects centered around water conservation and efficient usage. These could include watershed management initiatives, projects promoting the use of greywater, or programs incentivizing water-saving appliances.

Water Futures Market: Just like other commodities, water now has its futures market. The platform could provide an accessible, user-friendly interface for trading in water futures, making this market more approachable for investors of all scales.

Just as platforms have disrupted many traditional industries, a water platform could revolutionize how we invest in, manage, and value water. Such a platform would not only offer lucrative investment opportunities but also contribute to a more sustainable and equitable management of water resources.

We are already seeing the beginnings of this opportunity with companies such as Tap, where I am working towards this vision. Tap is in the process of building software to connect water devices, service providers, and data repositories all under one cohesive brand. With partnerships with industry giants like Apple, Elkay, and Hydro Flask, we aim to decentralize, streamline, and make accessible the world of water data and services.

In conclusion, water is not just a commodity; it's a new frontier of platform-based investment opportunities. As we navigate the complexities of the 21st century, finding innovative ways to value, manage, and conserve our most precious resource will be key. And the concept of a 'water platform' might be the drop of innovation that creates a ripple of change.

⚾ A Changeup to Blitzscaling

It's common to find startup leaders drawing analogies from the world of sports to articulate their strategies or outcomes, and baseball analogies are no different. A "home run" might signal a breakthrough success, or a "single" might reflect a modest gain. Reid Hoffman, the co-founder of LinkedIn, introduced us to the concept of 'blitzscaling', a type of company building synonymous with throwing fastball pitches - hard, fast, and designed to strike out the competition.

However, in a recent tweet, Reddit co-founder Alexis Ohanian questioned the effectiveness of this high-speed, high-risk growth strategy. This stirs up a debate: is being the first to scale always the best move? It's a question worth pondering.

Most industry analysts agree on the phenomenon of "winner takes most" in the startup world. However, I argue that these 'winners' are often the result of thousands of carefully made small decisions, rather than the mere advantage of being the first out of the gate.

Drawing again from our baseball analogy, consider an alternate strategy. Instead of throwing fastball pitches, what if startups adopted a slower burn approach, prioritizing methodical execution and precise product placement? Here's where we introduce the Eephus pitch to the game.

In baseball, an Eephus pitch is an intentionally slow, high-arcing toss that bewilders batters due to its unexpected pace and trajectory. It's a pitch that disrupts the game, providing a counterpoint to the fastballs typically expected.

Startup CEOs, as the pitchers of their teams, could benefit from introducing the 'Eephus' into their strategies. Here's why:

Patience Breeds Precision: In the startup world, growing sustainably often means making thousands of small, calculated decisions. Slowing down, akin to the Eephus pitch, allows leaders to gather and analyze data before making strategic moves. This leads to more informed decision-making and better-targeted product solutions. An Eephus strategy prioritizes the development of a solid product or service that perfectly fits market supply and demand, rather than rushing to be first. This focus on customer needs fosters a loyal user base, paving the way for sustainable growth.

Mitigate Burn Rate: Blitzscaling often entails a rapid burn rate. On the other hand, a slower, more methodical growth strategy often means more effective resource allocation, extending your startup's runway and providing a better chance at long-term success.

Flexibility and Adaptability: The Eephus pitch surprises and confuses batters because it's not what they're expecting. Similarly, a startup that doesn't always conform to the breakneck speed of blitzscaling can navigate the changing landscape with more agility, adapting to new market trends and customer needs.

In this new funding environment, startups must rethink the incessant pressure to blitzscale. Just as baseball pitchers have an array of throws in their repertoire, startup CEOs must diversify their strategies beyond merely being the first to scale.

The startup Eephus - a methodical, slower-paced approach to growth - allows for careful decision-making & fosters a customer-centric culture, mitigates the burn rate, and increases adaptability. These aspects could prove decisive in the unforgiving, dynamic world of startups.

Like in baseball, the game of startups isn't won by who throws the hardest or fastest, but by who plays the smartest. Sometimes, a well-placed Eephus pitch can change the game, especially when it’s time to prioritize efficiency over speed.

🤑 Venture Capitalists are not Bigoted Racists

The world of venture capital has long been criticized for its lack of diversity in funding, with statistics revealing a significant disparity in investment allocation for women and BIPOC (Black, Indigenous, and People of Color) founders. However, it is important to consider that this discrepancy may not solely be the result of overt bigotry or racism. Other factors, such as the nature of businesses that attract the majority of venture capital investment, known as network effects businesses, play a role in shaping the funding landscape. In this blog post, we will delve into the nuances of this issue and explore how factors like access, experience, and unique founder characteristics have contributed to the state of venture capital and startups.

The Funding Gap

It is no secret that women and BIPOC founders receive a significantly smaller share of venture capital funding compared to their white male counterparts. A study conducted by RateMyInvestor and DiversityVC between 2013 and 2017 revealed that only 9% of VC-backed startups were founded by women, and a mere 1% were founded by Black entrepreneurs. This stark disparity has fueled accusations of bias and discrimination within the venture capital industry.

Access to Venture Capitalists

However, it is crucial to consider the context surrounding these statistics. Anecdotal evidence suggests that individuals from minority backgrounds may actually find it easier to secure meetings with venture capitalists than their white counterparts. For instance, some black founders have managed to secure an impressive number of meetings with VCs, 150 or 250 meetings, indicating a higher level of access. My personal experience as a non-visible minority who has raised tens of millions of venture capital, is that securing more than 10-15 meetings during a fundraising round can be challenging.

The Power of Network Effects Businesses

So, what explains this phenomenon? The answer may lie in the power-law dynamics of venture capital investments. The majority of value generated by startups stems from network effects businesses, which tend to create a winner-takes-all scenario. Network effects have been responsible for 70% of all the value created in technology since 1994, by companies such as Google, FaceBook, EBay, Uber, Snap, Twitter, etc. Direct to Consumer companies of the 2010’s including Harry's, Casper, Rent The Runway, The Real Real, and Dollar Shave Club, while successful, do not fall under the network effects category.

Several factors contribute to the predominance of white men in the network effects business sphere:

Early access to computers and the internet: White adults are more likely to have had access to a desktop computer and high-speed internet at home, even as recently as 2021. This implies that successful tech founders, with an average age of 45, likely had early exposure to computers before they became mainstream.

Traits associated with autism (e.g., Aspergers): Some successful tech entrepreneurs exhibit traits associated with autism, which can foster intense focus on a specific subject. Autism Spectrum Disorder is five times more common in men. Examples of tech founders on the spectrum include Elon Musk, Mark Zuckerberg, Vitalik Buterin, Adam D'Angelo, and me.

Self-taught in isolation: Many male founders have taught themselves programming or product design, often in isolation. This process can be challenging but is sometimes perceived as a societal expectation for male individuals, who are judged based on their accomplishments.

Learning about Network Effects Businesses

It is important to note that the predominance of white men in network effects businesses does not imply that only they can succeed in this sphere, nor does it suggest that venture capitalists deliberately exclude women and BIPOC founders. However, it highlights the significance of education and exposure to the principles and strategies behind these types of businesses. The NFX Masterclass, for instance, serves as an excellent resource for anyone seeking to learn more about network effects businesses and how to build and scale them effectively.

Conclusion

While there is an undeniable funding disparity between white male founders and women and BIPOC founders, labeling or implying that venture capitalists are inherently bigoted or racist oversimplifies the issue. It is crucial to focus on understanding the nature of network effects businesses and work towards democratizing access to knowledge, resources, and opportunities for all founders, regardless of their background.

🥊 Startup Capital Raises: Proposing a Simpler Naming Convention

If you've been navigating the startup industry for any length of time, you're well-acquainted with the cryptic lexicon that defines each capital raise: Pre-seed, series seed, series A, series B, and so forth. Each of these terms has specific connotations and expectations attached, creating an intricate dance for startup founders as they seek investment.

However, the ever-shifting nature of the startup landscape and the variable sizes of funding rounds have created inconsistencies that make these terms less useful and more confusing. Today, we're going to dissect this conundrum and propose a more straightforward, intuitive solution.

Confusion in Conventions

To unpack this, we need to dig into the roots of the problem. The terminology of capital raising has long been in flux, and startup founders often find themselves inventing round names such as "Series Seed Extension" or "Series A-1". This is usually an attempt to avoid signaling issues with their startup's performance or their ability to raise a full round.

However, this tweaking of the conventional naming system only creates more confusion. It sends mixed signals to potential investors, obscuring the true nature of the startup's financial health, and doesn't provide clarity on the actual funding stage.

Moreover, the sizes of these rounds have ballooned over the past decade. Ten years ago, a seed round was in the realm of $750,000 to $1,000,000. By 2021/22, that figure had skyrocketed to a staggering $5-10 million. But now, the pendulum seems to be swinging back, with seed rounds seemingly settling in the range of $1,000,000-3,000,000 (and less is more, in my opinion). These changes underscore the variable nature of the current system and the need for more transparency.

A Proposal for Clarity

As a 14-year veteran of the startup industry, both as a founder and an angel investor, I've witnessed firsthand the confusion these ever-changing definitions and round sizes cause. This is why I'm proposing a new, more simplified convention: "Round and #".

Let's strip back the terminology and call it what it is: Round 1, Round 2, Round 3, or 1st Round, 2nd Round, 3rd Round, and so on. The initial friends and family round can be referred to as Round 0, highlighting its inception-stage nature.

In this proposed system, the round number, not an elusive letter, signifies the stage of the startup. It's a transparent approach that makes it clear how many times a startup has returned to the well for funding, without implying any specific performance level or round size.

Embracing Change

The startup industry is a dynamic, fast-paced world that thrives on innovation. However, to foster a healthy and transparent ecosystem, we need conventions that can keep up with the changing tides. As we evolve our businesses, technologies, and strategies, we should also evolve our language and communication.

By switching to a numbered round system, we remove the opacity around a startup's funding journey, presenting a clearer and more accurate picture to both current and potential investors. This shift will not only simplify the process but also ensure the language we use mirrors the transparency and authenticity we value in the industry.

Let's take the initiative to make the startup financing landscape more comprehensible. It's time to evolve from the conventional, and often perplexing, "Pre-seed, series seed, series A, series B, etc" into a system that truly mirrors our ever-changing industry. Let's make the jump to "Round 1", "Round 2", and beyond.

💸 Microsoft $3.16

Inspired by the GOAT Badass, Mr. Stone Cold.

In 1981, Microsoft raised a $1 million dollar seed round of venture capital. It was the only capital they raised before going public. $1 in 1981 is worth $3.16 today. Microsoft raised, in today’s dollars, $3.16 million.

Apparently, that’s barely even seed round “worthy” today. Has the startup community lost touch with how much money $1 million is? Yes. Completely.

The startups of 2022 are way over funded. Much of these budgets go to ad spend (50% to Facebook and Google ads) or to subsidize growth. Meanwhile the costs of starting a startup are the lowest they’ve ever been.

Great companies are going out of business and great founders are failing because capital is abundant and cheap.

Venture Capitalists need founders to spend cheap capital so markups can show paper returns and they can raise their next fund. Another fund means stacking AUM and management fees.

Founders spend that money because they like having a nice salary, large team, and comfortable office. I say this from experience.

But founders, have we forgotten legendary grit stories like:

Airbnb bootstrapping by selling $20,000 of Obama Os’s and Cap'n McCains?

Reddit getting acquired for $10 million by Conde Nast having raised less than $100K?

Atlassian founders holding a combined 75% at IPO because they raised zero in venture capital?

I certainly haven’t. The abundance of cheap capital results in venture capitalists having to tell founders that $1MM isn’t even on their radar. That’s true and unfortunate.

Not only am I, a serial founder whose previous company is on a path to IPO, not on Bri’s radar, her position means that she’s not on mine either. I have never met or spoken with Bri, nor is this a shot at her. She is stating a fact of her business and I’m grateful to her for sharing it.

I think there is; however, an obvious bias—the worst thing that could happen to a seed stage VC is if we stop taking $3-6 million of their capital for 20% of our companies. That’s why equity crowdfunding is a significant threat to venture capitalists.

$3.16 million. Your mileage may vary.

My company, Tap, has raised only $2.1 million in the last 4 years. I’m striving to not accept more than $3.16 million before taking the company public. Why? Because I’m a competitive person and I’m challenging myself. Constraint breeds creativity.

To every VC and founder who thinks pure software companies need $3-6 million seed rounds or billions of dollars of capital to reach the public markets, my response is this:

Au contraire. Microsoft $3.16.

Respectfully,

SIR

🎙️ Doubling Down on PodSnacks

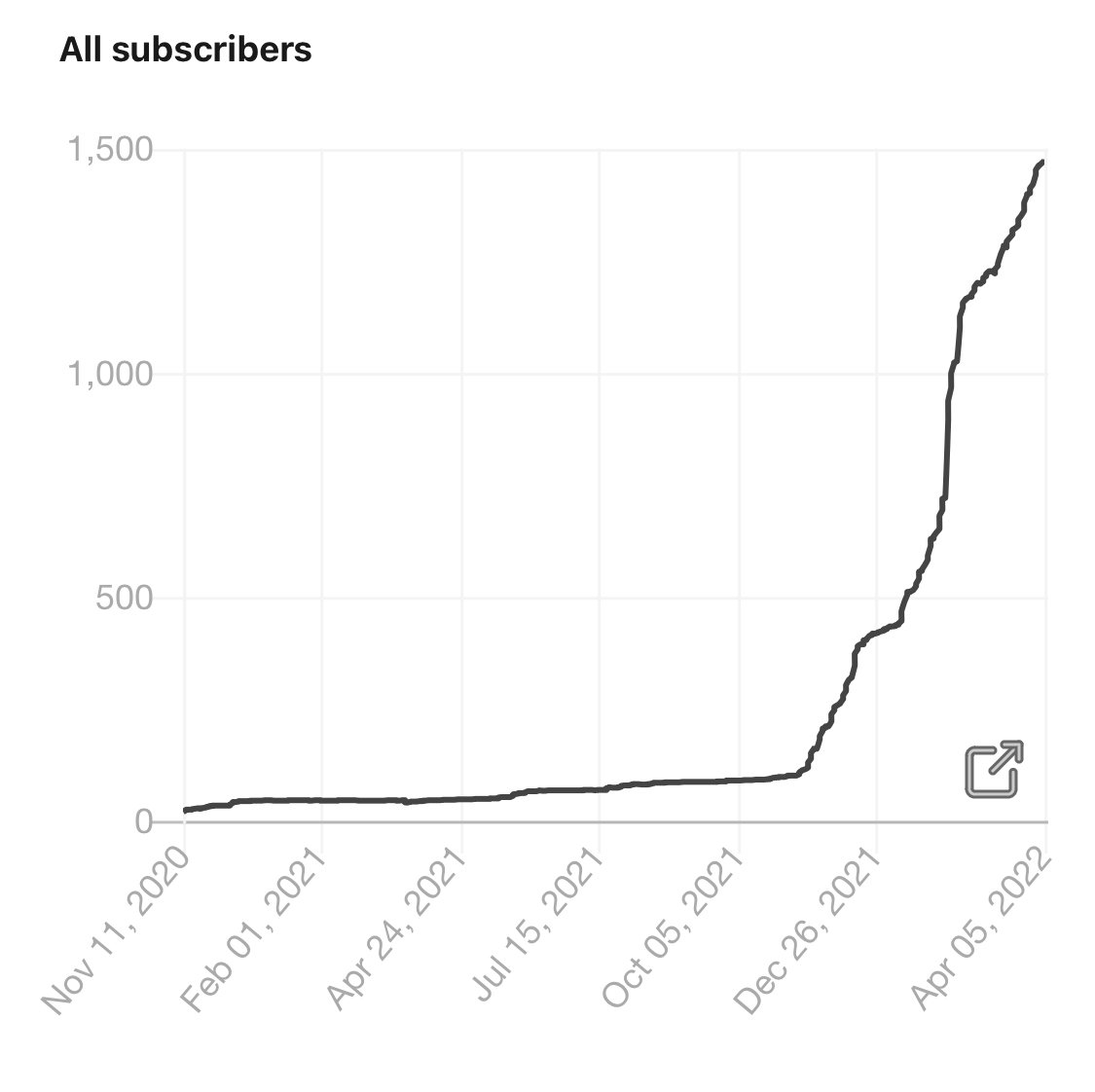

In November 2021, PodSnacks was not growing rapidly after a full year of Laura (@SnackQueen) working on it. Laura and I had a conversation about PodSnacks’ next steps.

I advocated the company did not have product market fit and needed a product iteration. So, Laura went to the drawing board and created “PodSnacks Picks,” a free weekly roundup of the PodSnacks summaries (“Bites”).

Laura then sent out 7 cold messages on LinkedIn promoting the new newsletter and 3 responded in the affirmative. This was markedly different than the hundreds of messages she sent in the past with no response.

After months of cranking on both the PodSnacks Picks newsletter and cold outreach, PodSnacks is in a very different place. PodSnacks grew from 100 subscribers in November, which took Laura almost 1 year to reach, to ~1,500 subscribers today.

PodSnacks has 23 premium subscribers who pay $5 per month for access to the entire PodSnacks’ summaries, and PodSnacks earns money from advertising in the free newsletter.

For weeks, Laura and I have been having conversations about how PodSnacks has validated its concept:

It grew 14x in 5 months

A test of paid ads acquired new subscribers for about $1 per.

It was net income profitable in 2021.

Today, Laura and I both doubled down in PodSnacks with additional investment. She invested $500 and I invested $5,000. The money will be spent on advertisements and PodSnacks will start to test outsourcing content creation.

Let’s go, @SnackQueen! Let’s go, PodSnacks!

💧 Celebrating World Water Day: Hydro Flask x Tap

World Water Day, held on March 22 every year since 1993, celebrates water and raises awareness of the 2 billion people living without access to safe water.

The theme this year is groundwater. I’d recommend this article from Erin Brockovich to anyone who would like to learn more. Erin is a staunch advocate for communities across the United States who are concerned about their drinking water.

World Water Day is about taking action to tackle the global water crisis. I’m pleased to announce Tap’s newest partnership for 2022 with Hydro Flask. The #RefillForGood rally cry encourages everyone to replace single-use plastics with reusables and make good changes for good reasons. Stay tuned this year for exciting announcements!

🛡️ Water Security is a Matter of International Security

This op-ed was published today in the My Climate Journey community newsletter

For decades scientists have spoken about extreme weather events as the result of climate change. Well, “climate change has arrived,” and water change resulting from a changing climate will come primarily in two forms — drought and flood. Dilapidated water systems only exacerbate the problem.

Some recent examples include:

Floods in Western Europe have claimed almost 200 people with hundreds still missing.

The Western United States is in a historic megadrought and shortage limits loom.

The Great Salt Lake, the largest salt lake in the Western Hemisphere, is shrinking rapidly. It could become one of the larger dust emission sources in North America.

In Tampa, Florida, 600 tons of dead fish washed ashore possibly as a result of the 215 million gallons of leaked polluted wastewater.

An estimated 1 billion marine animals were killed on Canada’s coast from a “Heat dome.”

Water will be at the center of many of the headlines, from rising sea levels, to desertification, to drought and famine. It could get much worse with an estimated ~1 billion climate refugees this decade.

Water is personal for me. I grew up on a lake where I swam, fished, and played ice hockey. The lake suffered from season ending algal blooms during my childhood and rarely freezes over any more. 9 years ago this fall, Hurricane Sandy hit New York and my experience cleaning up in the aftermath led me to founding MakeSpace. Three years ago I took a pledge to never drink a single use plastic water bottle again after having an epiphany when I couldn’t find a water fountain on Google Maps.

Our current water systems were built during an age of water abundance. Accurate measurement and the actual cost of water weren’t a concern as there was plenty. Cities along the Colorado River, like Las Vegas, became an oasis due to inexpensive, abundant water.

Infrastructure that fueled that rapid development has fallen apart. It’s common for cities to lose 30-50% of their water due to leaks. “Every country faces different types of water challenges and will need to prioritize different tasks to achieve sustainable water management, such as treating wastewater, delivering clean drinking water, adopting stronger water management policies and investing in vital infrastructure” — it could only cost 1% of GDP.

Adam Smith’s The Wealth of Nations (1776) presented the paradox of the low value of exchange of water. But we have since entered the age of water scarcity. If we don’t accurately value and measure our most valuable resource, what will happen as climate change and water change worsen? It’s a harsh reality: Much more life on Earth will die.

Like many of you I am an optimist. Solutionists have to be. I believe we have the power to change the world. So what do we do?

1. Invest and rebuild our water infrastructure. Water is one system and it spans almost every sector: agriculture, infrastructure, marketplaces, microchips, smart cities, etc. Wired Magazine recently called water “the next hot investment.” Every dollar invested in water access and sanitation yields an average $6.80 in returns. ClimateTechVC just featured a column about #watertech’s watershed moment.

2. Demand action from government officials. Bottled water exists because of a failing tap water system. In the US, the EPA has failed to act on drinking water regulation for years. I recommend subscribing to Erin Brockovich’s newsletter and reading Troubled Water by Seth Siegel. Regardless of where you live, start the conversation and demand action with your local politicians about PFAs in drinking water, what corporations in your state pay for water, and resiliency of your local water systems to weather events.

3. Pay the real price of water. Residents of the Western USA in particular will see water restrictions. Shortening your showers isn't going to be enough. Salt Lake City residents paid one of the lowest water rates of major US cities — about half of what New Yorkers paid, a third of what Atlantans paid, and a quarter of San Franciscans. Block pricing is the best mechanism to encourage conservation and to democratize access to water to the poor. This is the opinion of the leading water economist, David Zetland. A higher price is an incentive to reuse water, install water-saving hardware devices, and ensure it is a human right. Israel leads in policy and technology and recycles 90+% of water. The US is at 5-6%.

Water security is a matter of international security [1, 2, 3, 4]. I began a vow of silence on July 1st to raise awareness for the global water crisis. As a spiritual person of the Jewish faith, the rainbow is a reminder of the covenant with G-d that he wouldn’t wipe the face of the entire Earth clean ever again. May the memories of those lost in recent events be a blessing, and serve as a reminder that we all have the power to end the climate and water crises. If it turns out that the climate crisis is World War III, then I know that We Can Do It!

Respectfully,

SIR

Samuel Ian Rosen, aka the artist Captain Planet, is the Founder of Tap, MakeSpace, PodSnacks and an angel investor in watertech. He is on a mission to eliminate the single-use plastic water bottle and democratize access to clean water by connecting it to the Internet. He graduated from The University of Virginia and is a nomad currently in Mexico City.

🤐 A Vow of Silence for Water

My journey to eliminate the single use plastic water bottle began with a 30 day pledge on February 21, 2018. That pledge became a challenge, that challenge created a habit, and that habit became my lifestyle. It’s been 1,226 days since my pledge to #DrinkDifferent and I’ve recorded savings of 919 plastic bottles since I started keeping tally. Today I am making another pledge.

In years past during Plastic Free July, a month-long global movement that helps millions of people be part of the solution to plastic pollution, Tap activated beach clean ups around the world. This July, I am taking a vow of silence for 30 days to raise awareness for the plastic pollution crisis and the global water crisis. I am choosing silence for the sake of the children of our planet, and will take part in the WE Charity’s #WeAreSilent Campaign.

Our voices are a powerful tool for social change — and so is our silence.

- WE Charity

In a social media world where everyone has a voice, I feel like there is far too much noise.* We live in a world where the most influential people, in particular those in power politically and socially, are not speaking enough about climate change and not doing enough to end this crisis before hundreds of millions of people die and potentially billions are displaced from their homes. While at times it can feel like the climate crisis is far away, or that we still have enough time to address it, people are dying around the world today — children in particular — from water related illnesses.

The WHO estimated in 2019 that “829,000 people die each year from diarrhea as a result of unsafe drinking-water, sanitation, and hand hygiene. Yet diarrhea is largely preventable, and the deaths of 297,000 children aged under 5 years could be avoided each year if these risk factors were addressed. Where water is not readily available, people may decide hand washing is not a priority, thereby adding to the likelihood of diarrhea and other diseases.” Bad water is literally liquid death.

We all learned the importance of proper hand washing during the COVID-19 pandemic. Right now in America 58 out of 1,000 Native American households don’t have access to indoor plumbing — I saw this firsthand. Just imagine if you didn’t have running water in your home, how much sicker you and your family could have been in the past 18 months? I believe clean tap water is a human right because it’s a matter of gender, social, and racial justice.

Bottled water is not the answer to these problems. According to research in The Big Thirst by Charles Fishman, in 2010 Americans spent $21 billion a year on bottled water, while $29 billion was spent on maintaining and improving the entire water infrastructure. Regardless of the type of packaging, bottled water is a symptom of a much greater problem of a failing tap water system.

Almost everyone heard Greta Thunberg’s rally cry that “our house is on fire.” It was the right time and place for the children to speak up and be heard. I think the time is now for the the adults to stop talking and start listening.**

So, here goes. I pledge to be silent and not speak a word for 30 days to:

Raise awareness for the plastic pollution crisis and inspire you to refuse single use plastics in your life this July.

Raise awareness for the dire needs of children, women, the poor, and BIPOC communities who are disproportionately affected by lack of access to clean water.

To inspire silence in you — be it an hour, a day, a week — because “the quieter you become, the more you can hear.”

If you wish to honor me with financial support for this artistic challenge, donations can be made to the WE Charity with the earmark for “Clean Drinking Water and Basic Sanitation.”

Talk with you later.***

-SIR aka Captain Planet

Notes

* For example, have you ever seen an Instagram post of the beautiful turquoise waters in the Maldives make any mention of how vulnerable these islands are to disappearing by the end of the century? What a buzz kill! I see countless Instagram stories from revelers dancing the night away in Tulum, but how many are even aware of the poisoned waters in its underground aquifer? I certainly wasn’t when I was there in 2015/16. The recent trend of changing outfits set to Busta Rhymes “Touch It” on TikTok “flexed” consumerism, yet behind the changing curtain is a fashion industry with poverty wages for garment workers that’s labeled modern slavery. Of course, there are exceptions. Shout out Venetia La Manna, for your inspirational work to educate and be fashionable with your #oootd (old outfit of the day), and Max La Manna for your inspirational work to eliminate food waste, reduce carbon emissions, and eliminate food packaging.

** I was very much inspired by John Francis, an activist who took a 17 year vow of silence.

*** I will selectively utilize written communication primarily for work; however, not at the expense of artistic expression.

👋 from Mexico City: Q2 Video Update

Video is a powerful way to communicate humanly and asynchronously in our new remote world.

Below is a 10 minute Loom, which includes an overview of the latest service that I’ve launched in Mexico City, Tap on Demand.

I am excited to create and share more videos as part of the growing trend towards transparency, a.k.a. building in public.

🎙️PodSnacks of My Interview on Water Voice

Recently I was hosted on the Water Voice Podcast. If you don’t have 53 minutes to listen to the full episode, then you can save 51 minutes by reading the PodSnacks below.

PodSnacks is a subscription newsletter that summarizes the latest podcasts. Soon PodSnacks will expand its sector coverage in the climate industry to include carbon and renewable energy, which will be included in the subscription. If you don’t want to miss out on the conversations happening in podcasts in the climate sector, and don’t have enough time to listen to them all, PodSnacks will save you a minimum of 12-15 hours each month for only $100 per month.

Startup founders and micro VCs can receive a significant discount code on PodSnacks by replying directly to this email.

Hosts: Greg Johnson & Kevin Kunz

Guest: Samuel Ian Rosen | Founder & CEO | Tap

Category: 🌐 Digital

Podcast’s Essential Bites:

[17:49] “I traveled through an airport with a [reusable] water bottle that I always carry […] and I filled it up at the water fountain and the water didn't taste very good. I believe […] the filter had to be changed. And at the time, there were obviously Uber and […] all these services that you can rate your experience just after using it. And I was like, I need to rate this water fountain and give it a poor rating. So my software brain […] opens up Google Maps and I type in water fountain. And when I didn't find any water fountains at Google Maps, I had this eureka.”

[18:40] “People say they drink bottled water out of “convenience”. But not being able to find water on Google Maps, in my opinion, is inconvenient. […] If you ask artificial intelligence like Siri or Alexa, hey, I'm hungry, it will actually give you search results listings of Yelp restaurants nearby. […] When I asked that query to Alexa, hey, I'm thirsty or tell me where the nearest water fountain is, it doesn't have a database of where water fountains are. So to me that is inconvenient.”

[19:59] “Marc Andreessen, an extremely well known entrepreneur and operator who started the Netscape browser and Andreessen Horowitz has this saying, which is: Software is eating the world. So I had this hypothesis, what if we could eat plastic single use bottles with software, not with some new type of hybrid technology of a bottle that disappears after it's used, but with ones and zeros with code.”

[20:27] “Tap is a software company and its mission is to eliminate the single use plastic water bottle and democratize access to clean water by connecting water to the internet. The first version of that was, let's find out where all of these water fountains are. So whenever I have my reusable bottle, I can just push a button and find the nearest place to fill up. That was the first part of understanding the supply side of a two sided marketplace for tap water. The demand side, the buyer side, [is] you all […] at your homes, you buy water from the utility company, when you go to a station at the airport, you get water for free.”

[21:10] “It's my belief that the marketplace is broken, that […] water is completely mispriced. And that paradox is best seen at the airport, where a bottle of water is […] 4-5 bucks and tap water is free. And I believe as the world moves from a world of […] water abundance to water scarcity, as a result of climate change, that price of water will be the mechanism that is best used to conserve water [and] to invest in our water infrastructure, which we need to rebuild and bottled water will no longer be the backup or the failsafe. We will reinvest in our tap water infrastructure with software. And that's where Tap hopes to create all of this software to provide this service to the marketplace.”

[25:17] “Nestle’s CEO would say [they] are providing a valuable product, packaged bottled water to a consumer. And if [they] stop selling single use plastic bottles, people will shift their behaviors to drinking more soda, and so that’s not healthy and that's then a public issue of health. That person's correct. People will shift their consumption to sugary beverages. But what do we do about it, when the CEO of Nestle pays $200 to extract […] basically unlimited amounts of water from Michigan. They're not paying the environmental capital of the cost, the true cost of that water as a result of pulling it out of that aquifer. So essentially, what's broken is the capitalism system does not take into consideration the full price of all of the costs of goods sold.”

[26:19] “If I were the CEO of one of these companies, let's take Coca Cola, who [is] the largest polluter based on ocean plastic […]. What I would recognize is the [increase of the] margin profile […] when I remove the packaging. […] Coca Cola already has coke freestyle […] machines that you see at the […] movie theater, or the sandwich shop […]. That concentrate when they ship it weighs far less than the single use plastic bottles that are prefilled with water in a centralized system that was only centralized because of technology and plastic […] New technology, plastics make it cheaper, they consolidate it. What's happening now is software is, we will see a decentralization again. And what I would do is not ship plastic bottles with water, which is very heavy, because 65% of the cost to the end consumer of a beverage is packaging and transportation. And we haven't even figured in a carbon emissions tax yet. So […] I would focus the company on saying, hey, we're going to build a brand of a suite of package free options and we're going to be the leader.”

[34:13] “No matter the amount of money [invested by the government in water infrastructure], I believe we need to think like a startup that doesn't have money because innovation is born not from money, but from lack of it. […] The average lifetime of a water well […] in a developing country is about two years […]. The main reason is because if there's a well dug, and that water is free, people use it and ultimately they splash water on the ground and then bugs develop and then animals are attracted to the bugs and then there's a break in the well and no one takes care of it. It becomes this tragedy of the commons and it's a dilapidated infrastructure. […] However, with software, an IoT device and […] mobile payments, we can create a local economy […] of operators to take care of that infrastructure, have the money, create jobs, reinvest, build more wells, bring more clean water to people, by changing one thing, the price. By changing one thing, it going from a free well to adding some software. So […] I think there's a major need for software in the space.”

[45:18] “I think climate tech is going to be the hot category for the next few years. Wired magazine just […] wrote [that] water is the new hot investment sector.”

Rating: 💧💧💧💧

🎙️ Full Episode: Apple | Spotify

🕰️ 53 min | 🗓️ 05/06/2021

✅ Time saved: 51 min

Additional Links:

AquiPor Technologies

Disclosure:

I am an investor in AquiPor, which produces Water Voice, and a co-founder of PodSnacks.

💉Upgraded my OS: Received the COVID-19 Vaccine

Today I received the vaccine for COVID-19 in Bristol, Vermont. It was incredibly easy to schedule, well run, and a quick process.

I was most surprised that in 2020 the evidence of my vaccine is a paper card that could easily be forged by an ill-intentioned person.

There is nothing proprietary about this card except for the “Lot Number,” and since I’m not sure what that is, I won’t publicly post the picture of my card. It’s probably just the batch of vaccines in case something goes wrong and a doctor could warn others.

After staying in Germany for almost 6 months, one of things I was most impressed with is their systems. Things that don’t run well in America, like the post office, run very well in Germany. The Germans are known for precision engineering (Audi, BMW, Mercedes), innovative design (home windows that TILT!), and efficiency.

Their patient records system is apparently very good. I say “apparently” because I didn’t use it myself. The United States needs much better digital systems, in particular medical record systems, if we’re going to get our population healthy.

But so much money is in keeping Americans sick that it will require a system wide hard reset.

💧Captain's Log: Q1 2021. Tap Updates, Podcasts, Music, Books, and more

Hi Everyone,

I’m experimenting with a new email update format.

Below is a quarterly round up of the latest at Tap, new projects, and media recommendations with links to explore further.

I’m sending you all my best from Bavaria, Germany.

💧 Tap

Here is a recap of 2020 and outlook for 2021.

Now you can win prizes for drinking Tap! Join the Planeteers who are logging their plastic bottle savings with Tap’s DrinkwareOS, and you’ll earn entries to win in a weekly rewards sweepstakes.

Sign up, add a reusable, and log your first refill to enter to win (currently a $30 Amazon Gift Card).

If you’d like to accessorize your reusable, QR stickers and NFC Tags seamlessly connect to your Tap account and available for sale in the Tap shop.

🎙️ PodSnacks

In 2020, Snack Queen and I observed that there are tens of thousands of podcast episodes published a week but only 24 hours in a day. How could anyone listen to them all? So, we created PodSnacks.

PodSnacks is a paid subscription email newsletter that delivers the key takeaways from podcasts. For example, if a podcast is 45 minutes long, PodSnacks will save you 42 minutes of listening time by providing a 3 minute readable digest. Think of it like “Cliffsnotes for Podcasts.”

Here’s the PodSnacks of my most recent interview, and from the founders of Carmera, CityRow, and Zola. PodSnacks just launched specific verticals, with the first sector coverage of the water industry. If you would like coverage for your industry or topic, email PodSnacks at info@podsnacks.org.

😇 Angel Investments

"The next hot investment is water” - Wired Magazine - March 30, 2021

I am specifically focused on angel investing in the WaterTech sector. Water is heating up, but in the words of Lavar Burton, “you don’t have to take my word for it.” [one, two, three]

For example, I recently invested in Phuc Labs, a company that built a smart valve that leverages computer vision and artificial intelligence for water remediation and reclamation.

Contact me if you are or know a founder building in the WaterTech sector, or an investor who wants exposure to these opportunities.

💬 Articles

“We sampled tap water across the US – and found arsenic, lead and toxic chemicals” (The Guardian)"

“Scientists don't know why one-third of U.S. rivers have turned yellow or green” (Mic)

“California rainfall is at historic lows, water restrictions handed down this week” (SF Gate). Dry Conditions Early Warning Letters (CA Water Board)

📚 Reading Recommendations

Sacred Economics (Charles Eisenstein)

The Water Paradox (Ed Barbier)

The End of Abundance (David Zetland)

📺 Watching Recommendations

Sacred Economics (12 min)

Judas and the Black Messiah (126 min)

The Dissident (119 min)

🎵 Listening Recommendations

Goldcap | The Goldcast 062

Revelries, Henri Purnell | Feel it Still

Majical Cloudz, Alex Cruz, Brascon | Downtown

📰 Newsletters | Communities

My Climate Journey ($10 Per month). Especially helpful for those looking to transition into a climate career.

ClimateTech (Free). Round up of what’s happening in the ClimateTech investing space.

Pirate Wires ($10 per month). Essays on politics, tech, and current events from Michael Solana.

💼 Job Opportunities

Aaron Price | Hiring a non profit grant writer (2-3 weeks)

Daily Harvest | Director of Data Science, Head of Biz Dev/Strategic Partnerships

Elemental Accelerator | Strategic Partnerships, Head of People

Ritual | Chief People Officer

Unlocking the Physical World: QR Codes are a stop gap to NFC

For over a decade, the tech industry has built software to unlock physical objects. For New Yorkers, Zipcar was probably their first experience with tapping an RFID card against an object, a car, and unlocking the physical world. It was, and hopefully still is, a magical experience. Since then, scooter companies like Bird, Lime, Spin, Jump, Tier, Bolt and others (20+?) have brought this experience all over the world.

The pandemic popularized the QR code which is now 10+ Years old. Fred Wilson wrote a great blog post about this. But I think NFC tags are going to be even bigger than QR, which in my opinion are just a stop gap.

I recently read an article on App Clips. I think we're going to soon see a massive wave of companies using App Clips and QR/NFC to interact with physical objects.

From documentation, companies need to build AppClips as part of their native iOS application, but the end user does not need to download that application to interact with the physical object.

The marketplace of physical objects that can be unlocked is about to massively "tip," as the opportunity to not have to download an app will further reduce friction.

The solution to having 8 transportation apps on my phone may not be 1 transportation app to rule them all, rather no transportation app at all.

“Tap” will become the next verb (Uber, Google, Venmo). Tap could become the next “It’s like ____ for ____.”

Mark my words.

🌳Tree, I am no tree: The best carbon capture technology on the planet.

I just saw this tweet from Elon Musk:

I shared my first reaction with many others on the twitter thread who also thought “Trees!

Tree? I am no tree. I am the best carbon capture technology on the planet.

It’s not wise to bet against the real life Tony Stark, but it seems to me that trees are already, pound for pound, pretty much agreed as the best magical technology for carbon capture — but don’t take my word for it. See wired | bloomberg | guardian.

There’s startups out there like SilviaTerra and Pachama working on planting trees and building carbon offset marketplaces with artificial intelligence — verification via satellite imagery and machine learning to verify the forest wasn’t cut down — so that it becomes more economical for land owners to keep forests.

But I think the real problem is much deeper and more systemic. The real problem is our money system. Here’s an excerpt from a book I’m halfway through called, Sacred Economics by @ceisenstein.

Whereas interest promotes the discounting of future cash flows, demurrage encourages long-term thinking. In present-day accounting, a forest that has the capacity to generate one million dollars a year every year into the foreseeable future is considered more valuable if immediately cut down for a profit of 50 million dollars. (The net present value of the sustainable forest calculated at a discount rate of 5% is only $20 million.) This state of affairs results in the infamously short-sighted behavior of corporations that sacrifice (even their own) long-term well-being for the short-term results of the fiscal quarter. Such behavior is perfectly rational in an interest-based economy, but in a demurrage system, pure self-interest would dictate that the forest be preserved. No longer would greed motivate the robbing of the future for the benefit of the present. The exponential discounting of future cash flows implies the "cashing in" of the entire earth as opposed to an immediate wholesale “liquidation” of our remaining resources.

Perhaps the answer to carbon capture isn’t fancy new hardware but a change in society and our monetary system.

Currency Demurrage might actually be the answer to solving many of our environmental problems.

I’m currently about 50% through the book Sacred Economics. It’s fantastic. The author summarizes the highlights in this 12 minute video.

🎙️Introducing Podsnacks: "Cliffsnotes for Podcasts"

There’s so many high quality podcasts but not enough time to listen to all of them. This was the problem that my girlfriend, SnackQueen, and I identified while we were in quarantine in Vermont.

In one day we ideated and launched a new startup. It’s called PodSnacks.

PodSnacks is like “CliffsNotes for Podcasts.”

🎙️ Mission: Democratize access to high quality podcast content

⏰ Problem: So many podcasts, so little time

📰 Solution: Daily digest newsletter of the latest podcast episodes

The germ of the idea was SnackQueen’s. I extrapolated the problem and identified the business opportunity, and then drew up the blueprint. I created the logo (inspired by Apple), the name, designed the brand, and drove the format for the newsletter. SnackQueen is the builder with full editorial control. She selects the podcasts and writes the content.

PodSnacks Key Performance Indicator is ✅ Time Saved.

If a podcast episode is 45 minutes and the email takes two minutes to read, then the subscriber has saved 43 minutes. This translates to dozens of hours per month in time savings. In my own experience, there’s no way I can consume 4-5 podcasts a week as my entire focus is on water. Thanks to PodSnacks, I now have a daily newsletter summarizing the key bites of information from the most recent podcasts.

What's in a name? What a Montague and a Rosen have in common

Claire Danes and Leonardo Dicaprio in Romeo + Juliet (1996)

Juliet:

O Romeo, Romeo! wherefore art thou Romeo?

Deny thy father and refuse thy name;

Or, if thou wilt not, be but sworn my love,

And I'll no longer be a Capulet.Romeo:

[Aside] Shall I hear more, or shall I speak at this?

Juliet:

'Tis but thy name that is my enemy;

Thou art thyself, though not a Montague.

What's Montague? It is nor hand, nor foot,

Nor arm, nor face, nor any other part

Belonging to a man. O, be some other name!

What's in a name? That which we call a rose

By any other name would smell as sweet

These famous words from Shakespeare’s Romeo and Juliet describe the singular most important aspect of Romeo and Juliet’s lives that is preventing them from being together — their last names. Shakespeare uses a rhetorical question to ask the audience, “What’s in a name?” — a question which has been used for hundreds of years to communicate that the meaning of a name is more than just what we are called on a daily basis. A name carries its own reputation, power, and impact. [clip]

So, what’s in a name?

Two weeks ago I announced the launch of Drinkware OS to ~3,600 people via email and to 100 people via a physical letter, and instead of signing my name, I signed “Captain Planet.” While I haven’t pulled a Chad “Ochocinco” Johnson and legally changed my name to that of a 1990’s TV comic, I have decided to adopt this moniker in an artistic and professional context to highlight the massive challenge in front of us — saving Planet Earth.

When I was young, there was a comic on TV called Captain Planet and the Planeteers. Set in a dystopian world, with eco-villain arch nemeses like Captain Pollution, Captain Planet was a superhero who was summoned when 5 youths combined their own individual powers — Earth, Fire, Heart, Water, Wind.

Despite his own enormous power, he repeatedly reminds the Planeteers that their true power comes from within and they have the potential to succeed even without their rings. [source]

Captain Planet fighting Captain Pollution isn’t just the plot of a 90’s television show. It is, very much, the world we live in. During this pandemic, while many people stopped burning fossil fuels on a daily commute, the big oil industry has continued to produce virgin plastic and fueled their growth at an exponential rate. The NYTimes recently wrote Big Oil Is in Trouble. Its Plan: Flood Africa With Plastic. We must actively fight back.

As the leader of a movement to #Drinkdifferent and carry one's own reusable bottle, and of a technology company, Tap, which creates software to connect water to the Internet, I have planted seeds for a refill revolution. The name Captain Planet is symbolic that the power to actually change the world is not in one woman or man alone — the power is inside all people coming together. Said by Captain Planet himself,

Remember, the Power is Yours.

A host of research has shown that people’s names have a direct impact on their success — from increased hireability, to higher status positions at work, to increased chances of selection at competitive schools. Even after ~425 years since Shakespeare wrote Romeo and Juliet, the reality is that names still matter — maybe even more so. Anecdotally, whenever I’ve introduced myself in a professional capacity as “Captain Planet,” the first 2-3 minutes of the conversation have always been about my name choice and always discussed with smiles. In doing so, I created a friendly bond, raised awareness of the need to rebuild the tap water system, and advanced Tap’s mission to eliminate the single use plastic water bottle by connecting water to the Internet. That which we call a Rosen by any other name would smell as sweet.

I will continue to advocate using artistry and technology to make living in a world without single use plastics possible. I invoke the spirit of Captain Planet to call upon everyone in my personal and professional circles to take incremental actions every day. The power is yours to create a wave of change to take pollution and emissions down to zero.

Captain Planet

#DrinkTap: Here's the latest count of my plastic bottles saved.

Thanks: The Riveter and Snack Queen for reviewing drafts of this.